Emergency Funds Explained: Why They Matter and How to Build One Fast

When my daughter Penelope was born, everything changed—especially how I thought about money. Suddenly, the stakes were higher. I wasn’t just budgeting for myself anymore. I was budgeting for her future, her safety, her smile. And one of the first things I realized I needed was an emergency fund.

Not a vague “rainy day” account. Not a jar of coins on the counter. A real, reliable emergency fund.

If you’ve ever felt like you’re one unexpected bill away from financial chaos, this post is for you. Let’s break down what an emergency fund is, why it matters more than you think, and how to build one fast—even if you’re starting from zero.

What Is an Emergency Fund?

An emergency fund is a stash of money set aside specifically for unexpected expenses. Think car repairs, medical bills, job loss, or a broken appliance—not concert tickets or a last-minute vacation.

It’s your financial safety net. Your buffer between “I’ve got this” and “I’m panicking.”

What Counts as an Emergency?

- Unexpected medical expenses

- Job loss or reduced income

- Car or home repairs

- Family emergencies

- Unplanned travel for urgent reasons

If it’s urgent, necessary, and unplanned—it’s probably an emergency.

Why Emergency Funds Matter (More Than You Think)

Before I had one, I used credit cards to cover emergencies. It felt like a solution… until the interest piled up and I was stuck in a cycle of debt. That’s the trap many fall into: solving short-term problems with long-term consequences.

Here’s why emergency funds are game-changers:

1. They Keep You Out of Debt

Without savings, emergencies often mean borrowing. Credit cards, payday loans, borrowing from retirement accounts—none of these are ideal. An emergency fund lets you handle the crisis without creating a new one.

2. They Reduce Stress

Financial stress is real. It affects your sleep, your relationships, your health. Knowing you have a cushion gives you peace of mind. You can breathe easier, even when life throws curveballs.

3. They Give You Options

Lost your job? With savings, you don’t have to take the first offer out of desperation. You can wait for the right fit. Emergency funds buy you time—and time is power.

4. They Protect Your Progress

Maybe you’re paying off debt, saving for a home, or investing for retirement. An emergency fund keeps those goals intact when life gets messy. It’s the guardrail that keeps you on track.

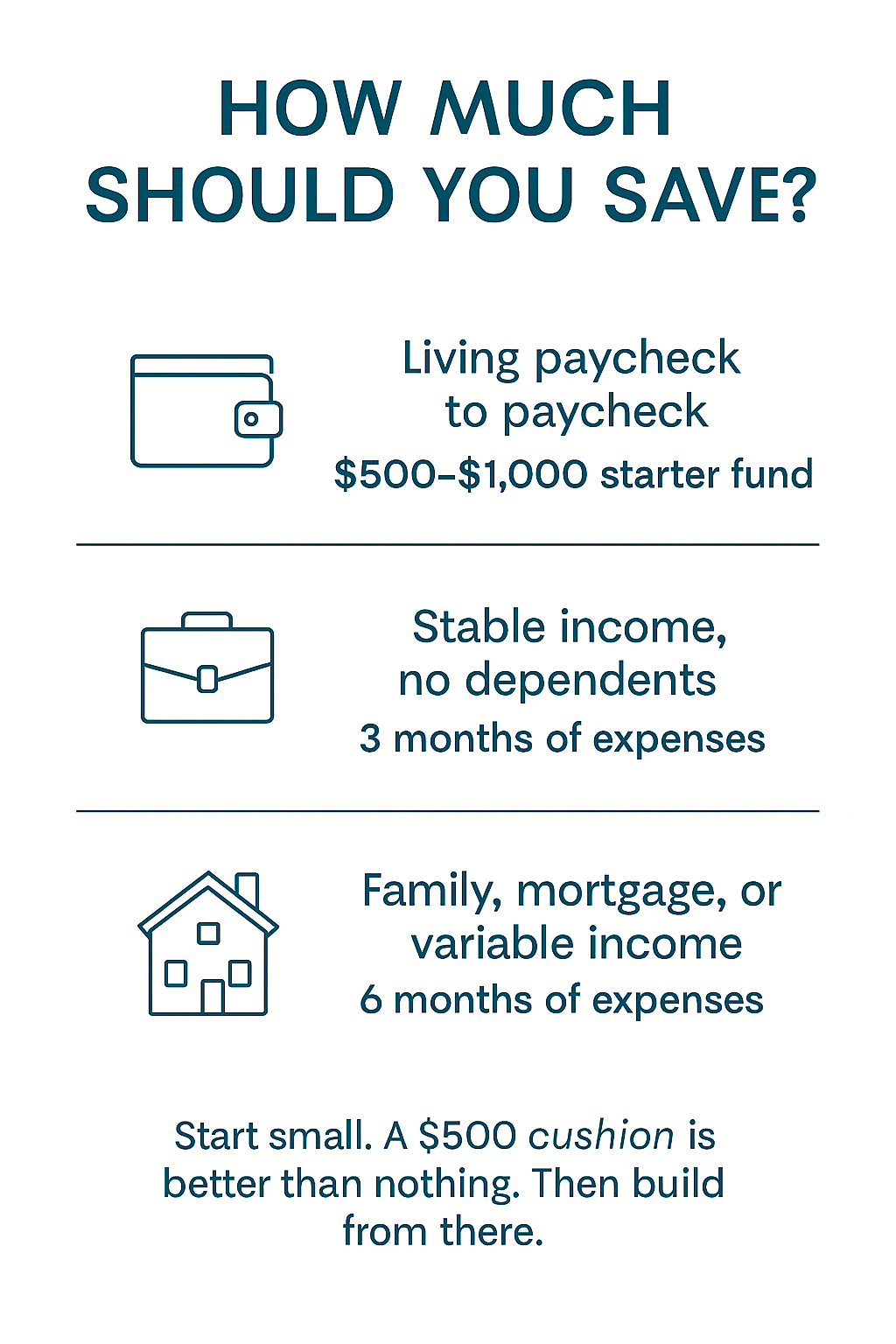

How Much Should You Save?

This depends on your situation, but here’s a general guide:

| Life Situation | Recommended Emergency Fund |

How to Build an Emergency Fund Fast

Let’s get practical. If you’re starting from scratch, here’s how to build momentum quickly.

1. Set a Clear Goal

Pick a number. $500? $1,000? Write it down. Make it real. This gives you direction and motivation.

2. Open a Separate Account

Keep your emergency fund separate from your checking account. Out of sight, out of temptation. A high-yield savings account is ideal—safe, accessible, and earning a little interest.

3. Automate Your Savings

Set up automatic transfers. Even $10 a week adds up. Automation removes the friction and builds consistency.

4. Cut One Expense Temporarily

Pause a subscription. Cook at home. Skip the coffee shop. Redirect that money to your emergency fund. It’s not forever—it’s for your future.

5. Use Windfalls Wisely

Tax refund? Birthday money? Side hustle income? Put a chunk into your emergency fund. It’s tempting to splurge, but this is your chance to leap forward.

6. Sell Something You Don’t Use

Old electronics, clothes, furniture—turn clutter into cash. Use Facebook Marketplace, Poshmark, or OfferUp. Every dollar counts.

7. Take a Savings Challenge

Try a 30-day savings challenge. Save $1 on day one, $2 on day two, and so on. By day 30, you’ll have $465. Make it fun. Get the family involved.

Mindset Shifts That Help

Building an emergency fund isn’t just about money—it’s about mindset. Here are a few shifts that helped me:

- “I’m not saving for someday. I’m saving for stability.”

- “Every dollar saved is a dollar I won’t have to borrow.”

- “I deserve financial peace—even if I’ve made mistakes.”

You don’t need to be perfect. You just need to start.

Tools to Help You Get There

To make this easier, I’ve created a free **Emergency Fund Tracker** you can download [here]. It’s simple, visual, and motivating. You can also use budgeting apps like:

- YNAB (You Need a Budget)

- EveryDollar

- Goodbudget

- Google Sheets or Excel (I’ve got templates for that too!)

What If You Can’t Save Right Now?

I get it. Sometimes there’s just no wiggle room. If that’s you, here’s what I recommend:

- Start with pennies. Literally. Round up purchases and save the change.

- Look for community support. Some nonprofits offer emergency grants or financial coaching.

- Focus on income. A side hustle, freelance gig, or selling unused items can jumpstart your fund.

Even $5 is a start. Progress beats perfection.

One more thing: Your Emergency Fund Is a Gift to Your Future Self

When Penelope was born, I didn’t just want to be a good parent—I wanted to be a prepared one. My emergency fund became a symbol of that commitment. It told me, “You’ve got this.”

And you do too.

Whether you’re starting with $5 or $500, every step you take toward building your emergency fund is a step toward freedom. Toward peace. Toward a life where money supports you, not stresses you out.

So start today. Your future self will thank you.