The Power of Compound Interest: Why Time Is Your Greatest Asset

I Wish I Had Learned This Sooner

Compound interest is one of the most important financial lessons I’ve ever learned. Honestly, I wish 18‑year‑old Legend had known what I know now. If I had started investing just $100 a week at 18 and kept going until age 34, assuming a 10% annual return, I would already have over $172,000 saved.

Even more mind‑blowing: if I kept that same $100 per week going until age 65, my retirement account would grow to more than $4.1 million. And here’s the kicker—I would have only contributed $225,000 of my own money. The rest? That’s the magic of compound interest.

What Is Compound Interest?

According to Investopedia, compound interest is “interest that is added to the initial principal of an investment or loan, thereby increasing the balance and, in turn, increasing the amount of interest earned or paid in the next period.”

In simple terms:

- You earn interest on your original investment.

- Then you earn interest on your interest.

- Over time, this snowball effect creates exponential growth.

Example:

- You deposit $100 at 1% monthly interest.

- After the first month, you earn $1.

- Next month, you earn interest on $101—not just $100.

- Repeat this process for years, and your money grows faster and faster.

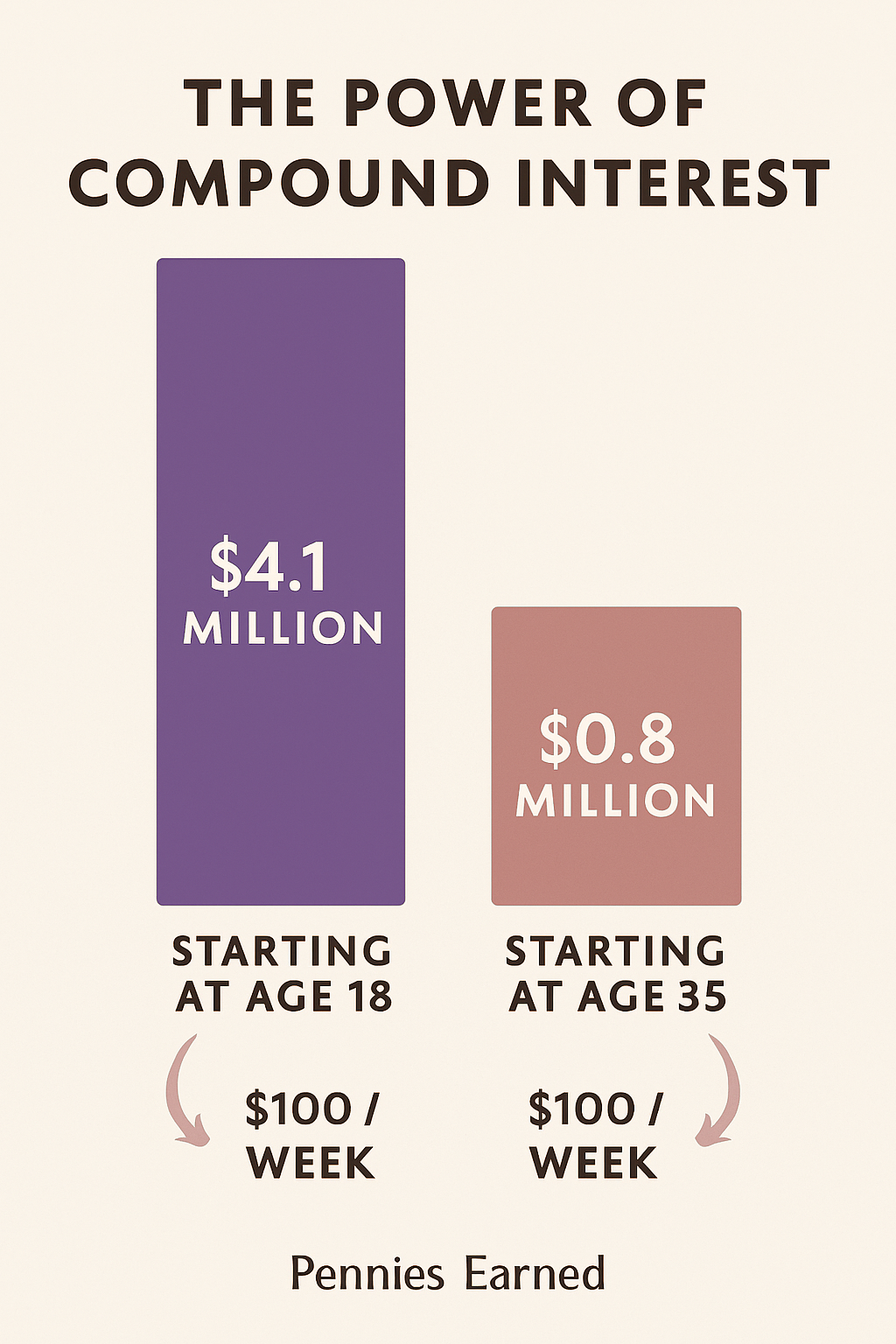

Starting Early vs. Starting Later

Let’s compare two scenarios:

- Starting at 18: $100 per week until age 65 at 10% = $4.1 million

- Starting at 35: $100 per week until age 65 at 10% = $789,000

That’s a huge difference. Starting later doesn’t mean you’re doomed—it just means you’ll need to save more aggressively to catch up. For example, to reach $4 million starting at 35, you’d need to invest about **$500 per week** instead of $100. For most people, that’s tough to sustain, which is why time is the most valuable factor in investing.

Why We Struggle With Compound Interest

The challenge is that compound interest takes time. We live in a world of instant gratification, but investing doesn’t work that way. The first few years may feel slow, but decades later, the growth becomes explosive.

That’s why the two most important steps you can take are:

1. Start now—no matter your age, the earlier you begin, the better.

2. Automate your savings—set up automatic transfers so your money grows without you having to think about it.

Final Thoughts

Compound interest is proof that small, consistent actions can lead to life‑changing results. Whether you’re 18 or 38, the best time to start investing was yesterday—the second‑best time is today.

👉 Want to learn how to automate your savings so you never miss a contribution? [Read my full guide here].