Dollar‑Cost Averaging Explained: A Beginner’s Guide to Smarter Investing in 2026

Introduction: Why Investors Struggle With Timing

One of the biggest challenges in investing is knowing when to buy. Markets rise and fall unpredictably, and even seasoned investors often fail at timing the perfect entry. For beginners, this uncertainty can be paralyzing. That’s where **dollar‑cost averaging (DCA)** comes in — a simple, disciplined strategy that makes investing less stressful and more effective over the long run.

What Is Dollar‑Cost Averaging?

Dollar‑cost averaging is the practice of investing a fixed dollar amount into an asset (like stocks, ETFs, or mutual funds) at regular intervals, regardless of price.

- When prices are high, your fixed amount buys fewer shares.

- When prices are low, your fixed amount buys more shares.

- Over time, this reduces your *average cost per share* and smooths out the impact of volatility.

Example: If you invest $500 every month into an S&P 500 index fund, you’ll accumulate more shares during downturns and fewer during rallies. This consistency builds wealth without the stress of market timing.

Why Dollar‑Cost Averaging Works

- Removes emotion: You don’t have to guess when to buy.

- Reduces volatility impact: You buy across highs and lows.

- Builds discipline: Automatic contributions create a savings habit.

- Accessible: Works for beginners with small amounts of money.

Step‑by‑Step Guide to Using DCA in 2026

1. Define Your Investment Goal

Are you saving for retirement, a home, or financial independence? Your goal determines the type of account (401(k), IRA, brokerage) and the investment vehicle (index funds, ETFs, stocks).

2. Pick the Right Account

- 401(k): Employer match makes DCA especially powerful.

- Roth IRA: Tax‑free growth for long‑term investors.

- Brokerage account: Flexible but taxable.

3. Automate Contributions

Set up recurring transfers from your bank to your investment account. Automation ensures consistency and removes the temptation to “wait for the right time.”

4. Choose Low‑Cost Investments

Index funds and ETFs are ideal for DCA because they offer diversification and low fees.

5. Stay Consistent

Stick to your schedule — whether monthly, biweekly, or quarterly. The key is discipline, not timing.

Real‑World Example

Imagine a young professional investing $200/month into a total market index fund:

- Month 1: Price $50 → 4 shares

- Month 2: Price $40 → 5 shares

- Month 3: Price $60 → 3.3 shares

Over three months, they’ve invested $600 and accumulated 12.3 shares. Their average cost per share is ~$48.78, lower than the highest price paid.

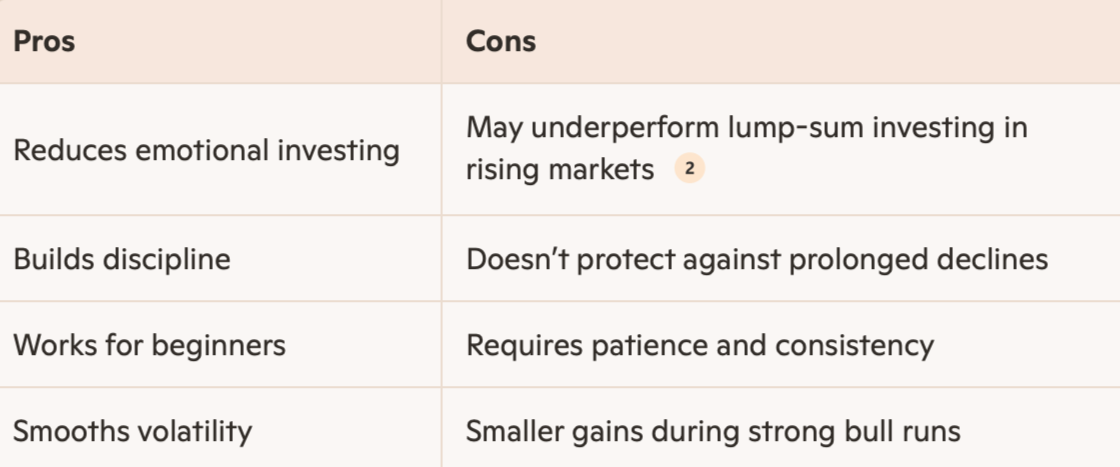

Pros and Cons of Dollar‑Cost Averaging

Common Mistakes to Avoid

- Stopping during downturns: DCA works best when you keep buying through dips.

- Choosing high‑fee funds: Fees erode returns. Stick to low‑cost index funds.

- Investing without a goal: Always align DCA with long‑term objectives.

Dollar‑Cost Averaging vs. Lump‑Sum Investing

Studies show lump‑sum investing often outperforms DCA because money is in the market sooner. However, DCA shines for risk‑averse investors who value peace of mind and discipline.

FAQs

Is dollar‑cost averaging good for beginners?

Yes. It’s simple, reduces risk, and builds investing habits.

Can I use dollar‑cost averaging with ETFs?

Absolutely. ETFs are ideal because they’re diversified and liquid.

Does dollar‑cost averaging guarantee profits?

No. It reduces risk but doesn’t eliminate losses in prolonged downturns.

Conclusion: Why You Should Try DCA in 2026

Dollar‑cost averaging isn’t about maximizing returns — it’s about minimizing regret and building wealth steadily. By investing a fixed amount regularly, you’ll avoid the stress of timing the market, reduce volatility’s impact, and create a disciplined path toward your financial goals.

Bottom line: If you’re new to investing in 2026, start small, stay consistent, and let dollar‑cost averaging work for you.